Among the Following Countries Which Attracts the Most Vc

The Netherlands passport is one of the most valuable and highly respected passports in the world ranked 4th powerful passport in world passport rankings with visa free travel to 173 world countries including United States United Kingdom and right to settlement in all 28 EU member states. Q4 funding clocked in at 24B a 117 increase QoQ.

Europe Value Of Venture Capital Investments By Country 2021 Statista

We even saw an increase in the percentage of funding coming from other types of investors making VC investments including corporates and family offices said.

. In line with other geographies Florida realizes a funding record in Q4. Of the top 5 largest deals executed in Q4 in Florida 4 of those companies hailed from Miami. 7- France 52 billion.

This suggests an opportunity for more growth for innovative Japanese start-ups if ex-Japan investors are attracted. Manigart and Wright and Vanacker and Manigart for some recent overviews of the general venture capital literature. Venture capital is a subset of private equity and refers to investments made for the launch early growth or expansion of companies1 1 See Drover et al.

These countries are followed by Germany The Netherlands Sweden Israel Spain Denmark and Belgium. Manigart et al 2002. While Germany is slightly above the average European attractiveness level the scores are rather disappointing for example for France Italy Spain and Greece.

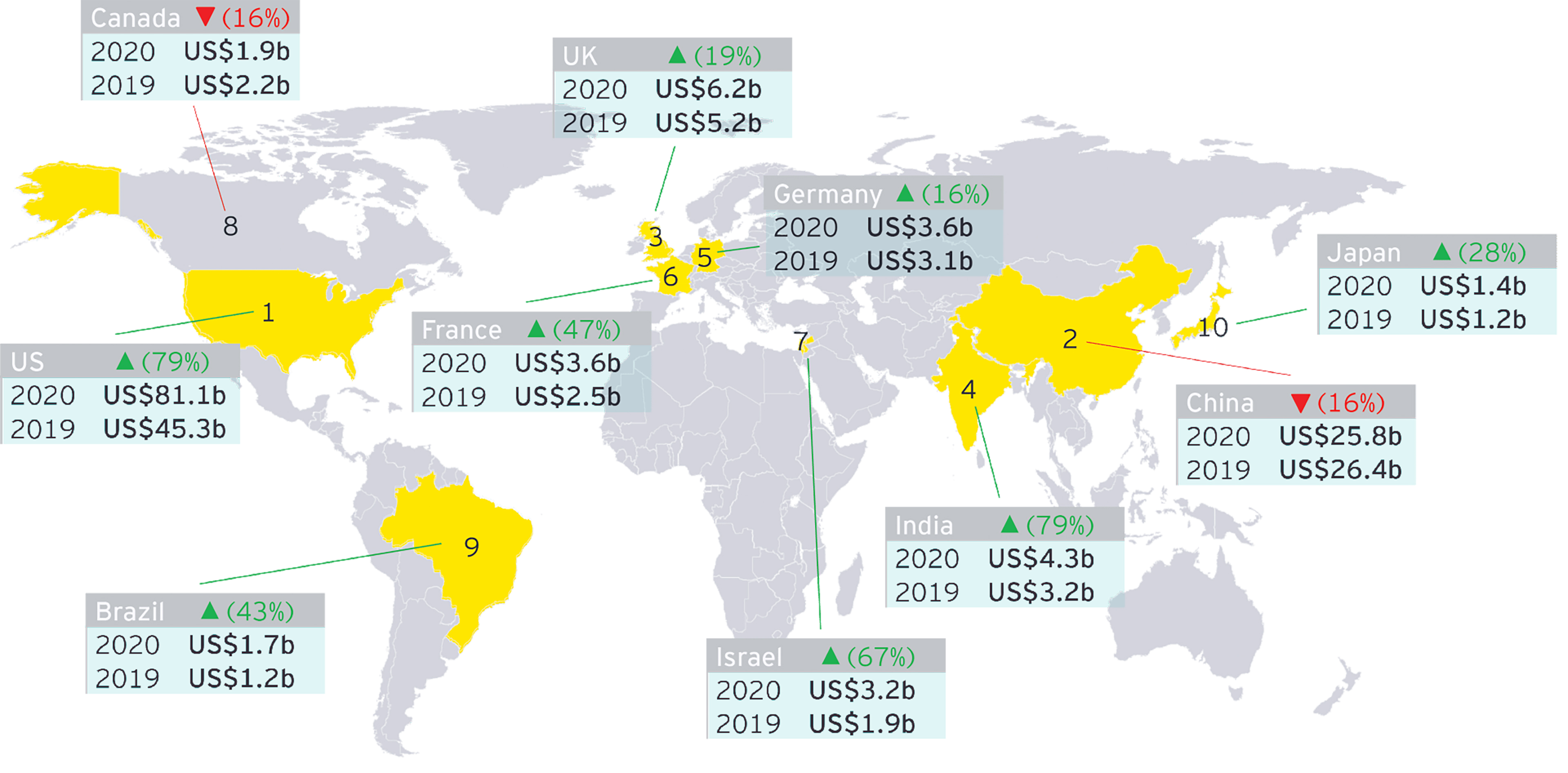

Of the emerging economies China and India made a mark with 33 and 10 billion. The United Kingdom leads our ranking followed by Ireland Denmark Sweden and Norway. The country in which most venture capital was invested in that time was the US with about 255 billion or almost 70 of the total.

The major reasons. It will help attract high-quality portfolio firms that are eager to help address some of the most. The main country to mention in this region is Argentina.

The data shows that the main early-stage financiers come from venture capital firms in the UK and Germany. South Korea fell just shy of the 5 threshold at 48 of the total index value. At the very top one can see the most wealthy countries including the UK 2nd Germany 9th the Nordic region Sweden at 7th Denmark at 16th Switzerland 8th and France 11th.

This follows the trend for Series A funding in Europe across sectors. Highlighting the indexs geographic concentration China and India were the only two countries that made up more than 5 of the index by market value and together they accounted for approximately 54 of the index Table 7. Notably several big pharma companies are leading some of the most active VC firms in Biopharma.

First knowledge of VCs practices are of. Currently Europe is home to 20 known fintech unicorns. Expand internationally with China and India among their top attractions.

The few startups that experience massive. Many high profile companies including Apple Facebook Spotify. Floridas VC market was ablaze in Q4 and 2021.

The unicorn hunters. Thanks to beneficial cooperation Mexican developers build their long-term relationships with new companies and partners. UK The UK is the 2nd country in our ranking thanks largely to London ranked 3rd globally for cities where the majority of accelerators coworking spaces and startups are.

100 of foreigners ownership. India attracted 49 billion in foreign investments in 2019 up 16 from 42 billion in 2018. Incidentally the countries that also receive the most fintech funding overall.

These are generally seen as the crown jewel of the sector. Statista The United States protein powder sales statistics predict steady growth for the market over the forecast period of 20202025. Among this group the role of pension funds and insurance companies investing in VC funds has been limited but is increasingly active in countries like Brazil Colombia and most recently México.

Paris is among cities hosting the most multinational corporations. This study should hold practical value for several reasons. The majority of FDI went into the services sector including information technology.

The key challenges identified are that few ex-Japan VCs invest in Japanese start-ups and the Japanese VCs provide the funding. Free corporate tax for foreign-sourced profits low tax rate from 825 to 165. The United States sports protein powder market was worth 414 billion in 2018.

Its also worth pointing out a couple of other reputable players to give a complete. Starting around 1 million. Sapienza et al 1996.

B A wave of theocratic revolutions occurred as people around the world looked to spirituality to guide them. D A totalitarian revolution swept the world as people looked to strong state leadership in uncertain times. Diversity was really the defining characteristic of the VC market globally in Q2 from the countries where deals occurred to the different sectors that attracted investment.

C Socialistic revolutions swept the world as countries aspired toward greater social justice. Developers from Latin America also are in demand among IT companies all over the world. Being a first mover as an ESG-oriented VC fund can become the source of competitive advantage.

Hong Kong is top-listed as an ideal country for offshore company formation for its strong international reputation and beneficial business schemes including. 2021 more than tripled 2020s volume at 57B. A well developed legal framework and stock market help attract foreign venture capital.

The latest data until Q1 2021 reveal a boom in healthcare since the Coronavirus 2019 Covid-19 pandemic outbreak. The VCs with the most exposure to these unicorns are Valar Ventures Hedosophia Balderton and. The European countries came in second with some 55 billion invested or just over a fifth of the amount invested in the US.

Most entrepreneurs manage to make money and maintain full control of their businesses. And the European area Manigart 1994. This study therefore was designed to examine the drivers of venture capitalist governance and value added in the United States and in the three largest markets for venture capital in Europe the United Kingdom France and the Netherlands.

Among them are Dell IBM HP and many others. In this context family offices and wealthy individuals have become one of the primary sources of funds for VC in the region. VC literature focuses on developed countries such as US.

Startups come and go and while nobody has an exact percentage most people put the startup failure rate between 80 and 90 percent. The United States protein powder market grew from 032 billion to 446 billion in one year. But foreign investors continued to pour money into the country.

If an entrepreneur is asking for 150000 in investment for 10 of the company the post-money valuation is 15 million. The size of the VC market in Japan was USD 123 billion in 2020 only 25 percent of the US market.

Vc Transactions In Cee Report 2021

Venture Capital Landscape In Sea

European Venture Capital S Resilience Through A Global Pandemic Ey Luxembourg

0 Response to "Among the Following Countries Which Attracts the Most Vc"

Post a Comment